If German Succession Rules do apply (and this is the case more often than one might think), then the surviving spouse, the children and even the parents of the deceased do inherit a portion of the estate no matter what, i.e. even if the deceased had expressly disinherited them in his Will!

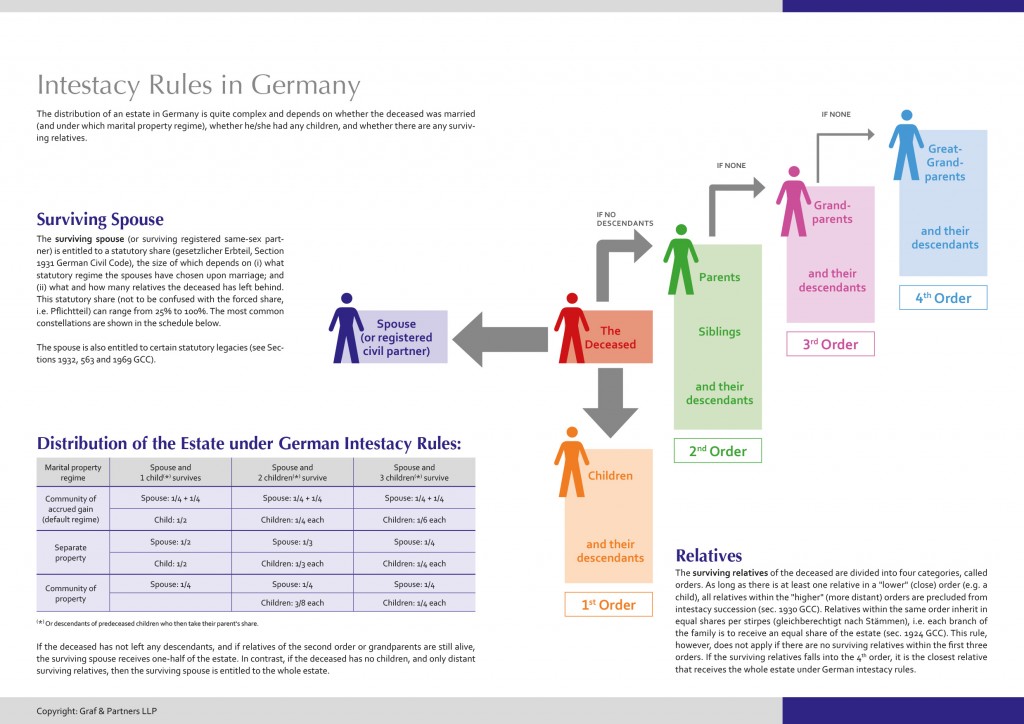

Under German law there exist strict forced share rules (Pflichtteil). In cases where the surviving spouse and/or close relatives, namely descendants or parents, have been disinherited, they are entitled to bring a pecuniary claim against the testamentary heirs. The forced share consists of 50 per cent of the pecuniary value (cash equivalent) the disinherited person would have received had the deceased died intestate (see flow chart below), i.e. the share he or she would have been entitled to by statute. Such claims even extend to gifts made by the deceased during the last 10 years of his or her life time.

Nature of the claim

Again: it is a purely pecuniary claim that may be brought against the testamentary heirs and not a claim to a share of the actual property belonging to the estate. Thus, the better term may actually be “compulsory portion”. Details about this German forced share and how it is calculated are explained in the post Disinherit your no-good children? Not so easy in Germany and in the free brochure on German Probate and Succession Laws: Download Brochure.

For more information on German-British probate matters and international will preparation see the below posts by the international succession law experts of Graf & Partners LLP:

- Most Germans die without a Will (German Intestacy Rules)

- Formal Requirements to set up a valid Will in England, Scotland and Germany: What are the Differences?

- The Perils of German IHT and Gift Tax

- Careful with Deed of Variation if Estate comprises Foreign Assets

- Basics of German Inheritance and Succession Law

- Executors and Trustees in German Inheritance Law

- How to apply for a German Grant of Probate

- The Infamous German Community of Heirs – And how to avoid it

- Germans Heirs are Personally Liable for Debts of the Deceased

- International Wills and Estate Planning for British-German Families

- Prove German Wills for English Probate

- Disputed Wills and Contentious Probate in Germany

- Disinherit your no-good children? Not so easy in Germany

- Don’t be afraid of Clients with Foreign Assets!

- Can foreign Taxes be set off against UK Inheritance Tax?

Or simply click on the “German Probate” section in the right column of this blog.

– – – –

The law firm Graf & Partners and its German-English litigation department GP Chambers was established in 2003 and has many years of experience with British-German and US-German probate matters, including the representation of clients in contentious probate matters. We are experts ininternational succession matters, probate and inheritance law. If you wish us to advise or represent you in a German or cross border inheritance case please contact German solicitor Bernhard Schmeilzl, LL.M. (Leicester) at +49 941 463 7070.

[…] What are the German Forced Share Rules? […]