German Intestacy Rules Explained

The German rules about what happens when a person dies without having made a valid will (intestacy), are set out in section 1923 to 1936 German Civil Code (Bürgerliches Gesetzbuch, an English translation being available here.

Intestate succession affects many families because roughly two out of three Germans die without having a valid Will in place. German intestacy rules are very different from those in Common Law countries. Children of the deceased have a much stronger legal position in Germany compared to children under English or USA succession law, where the spouse usually receives more than the children.

And there is the famous German “Pflichtteilsrecht” (“forced share” or “compulsory portion”), which appears a rather baffling concept to British or US-American succession lawyers, because it entitles one’s closest relatives to a share in the Estate (up to 50%) even if the testator cannot stand that person (for details see here).

Who gets how much under German Intestacy Rules?

Before we get too technical, let’s look at the outcome in the three most common constellations:

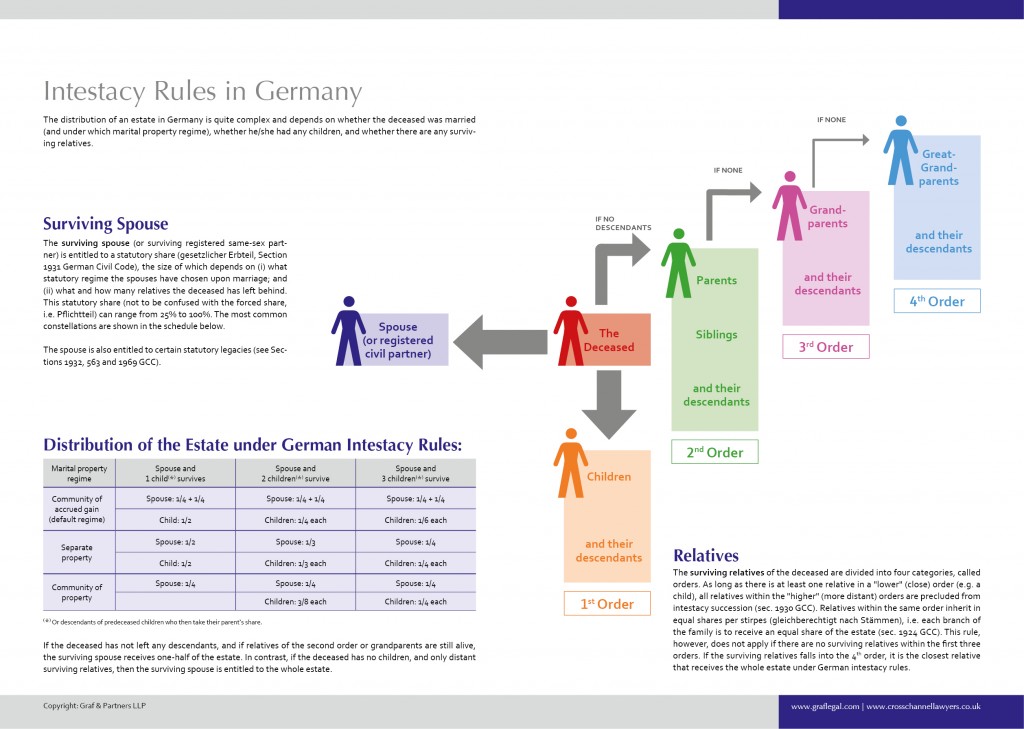

- Married couple with child/children: The general rule is that in most cases, half of the deceased’s estate goes to the surviving spouse, the other half goes to the child of the deceased (if more than one child, the children have to split this half share between themselves). This is, however, only true if the spouses live in the German default marital property regime (gesetzlicher Güterstand) which is the regime of Zugewinngemeinschaft (community of accrued gains), because the 1/2 share of the surviving spouse consists of two elements: (i) the inheritance share itself and (ii) a family law element, i.e. an allowance for accrued gains during marriage (pauschalierter Zugewinnausgleich). Thus, if the spouses have changed the German standard marital property regime, which is only possible by entering into a formal agreement recorded before a German notary, then the share of the surviving spouse can be different. Details are explained in the graphic chart above.

- Married couple and no children: Here, in most cases, the surviving spouse receives 3/4 of the deceased’s estate, the rest goes to the parents or (if they have predeceased) the sibling(s) of the deceased! This is a result, which the deceased in most cases would never have intended. Since this particular German intestacy rule is something which many couples are unaware of, this outcome leads to the most ugly disputes between the surviving spouse and the brothers or sisters of the deceased, who are now suddenly co-owners of the family property.

- Not married: Everything goes to the child (or children). If there are no children, then everything goes to the parents of the deceased. If they have already passed away: the siblings of the deceased.

If the family situation is more complex, especially in patchwork constellations, the intestacy rules can lead to quite unfortunate results, especially since under German probate law there is no personal representative who is responsible for the administration of the estate and can take care of matters. Instead, all co-heirs (Miterben) must act together and are forced to agree about everything by unanimous vote (section 2032 German Civil Code). In other words: Even a co-heir who has only a minute share in the estate, can block the administration of the estate by constantly voting against the majority. In practice, this means that houses and stock can’t be sold, bank accounts can’t be closed, monies can’t be distributed until all (!) beneficiaries unanimously agree or until a German Court of Law has decided. Thus, contentious probate and disputes among co-heirs are rather common in Germany, because intestacy rules often create a community of heirs consisting of people who cannot stand or do not trust each other.

For Lawyers

In more generic terms and technical legal lingo, the German rules on intestacy can be explained like this: Legal heirs (gesetzliche Erben) in Germany are determined by employing a rather complicated parental system per stirpes. On intestacy, German law distinguishes between certain “orders of succession”. These orders (degrees or categories of German succession law) are:

- 1st Order: children of the deceased and their descendants;

- 2nd Order: parents of the deceased and their descendants;

- 3rd Order: grandparents of the deceased and their descendants;

- 4th Order: great-grandparents of the deceased and their descendants.

Each “Ordnung” precludes the following orders, i.e. as long as any relations of one of the prior orders can be located, all those of the next order are excluded from benefiting. Relatives within a particular category inherit in equal shares (succession per stirpes). Within a particular degree, an existing beneficiary excludes all his or her descendants from benefiting.

What about the Surviving Spouse?

Under German intestacy rules, the surviving spouse (or registered same sex partner) also has a right of inheritance, which is also influenced by the matrimonial property regime the couple has lived in. The actual percentage depends on whether the deceased had any close relatives. The surviving spouse of the deceased is entitled to receive:

- 1/4 of the estate (plus the martial property regime allowance if applicable) if there are any surviving children (or their issue) of the deceased

- 1/2 of the estate (plus the martial property regime allowance if applicable) if the deceased is survived by his/her parents or their issue (i.e. sisters/brothers or nieces/nephews of the deceased) or grandparents

- The total estate if the deceased is not survived by any issue or parents

In addition, the surviving spouse is entitled to the following statutory legacies:

- household and personal effect / personal chattels (Hausrat) and

- the wedding presents (preferential benefit)

Please note that the above percentages only apply if the spouses have not altered the German standard marital property regime (see in particular section 1371 German Civil Code).

Also, and this is another big difference to the situation under English succession law, the spouse is not entitled to anything under German intestacy rules if at the time of the death of the deceased the requirements for the dissolution by divorce of the marriage were satisfied and the deceased had petitioned for or consented to the divorce (section 1933 German Civil Code). So there is no need for a final court order. Formally initiating divorce proceedings is enough to assure that the (soon to be ex-) spouse is no longer entitled to any statutory inheritance.

In these posts, you can find more information on German Probate, German Inheritance Tax and Will Preparation. In case of contentious probate, disputes can be brought either before a German Probate Court (Nachlassgericht) or before the Civil High Court (Landgericht). More on civil litigation in Germany here and on the website of our litigation department (GP Chambers, German Barristers).

Watch our video which answers the24 most frequently asked questions on German probate and estate administration (for the list of questions see below the video)

1) What is an “Erbschein”? (00:11)

2) Is the process for hiring a German lawyer different from hiring a lawyer in the States? (00:57)

3) How much does it cost to hire a European Lawyer? (02:06)

4) My deceased relative owned property in Europe. Do I need a separate grant of probate for those assets? (03:04)

5) How does German or English probate differ from American probate? (04:01)

6) Can I be personally held liable for the debts of an international estate? (04:47)

7) What documents do I need to submit to the German and English probate courts to have access to he estate? (05:47)

8) How long does the international probate process take? (06:58)

9) Will I have to travel to Germany or England in order to access the assets my loved one land? (07:41)

10) What are the rules of intestacy in Germany? (08:22)

11) How can we sell foreign assets in an estate? (09:16)

12) How can I get access to assets in Germany or England? (10:09)

13) Who administers a foreign estate if there is no Will? (11:07)

14) How can I swear the oath or give the affidavit with regards to the probate application? (12:11)

15) How do I get an inheritance tax clearance from German and England? (13:20)

16) Is there an estate tax on foreign assets? (14:29)

17) I received a letter from German probate court because a relative has died. What do I need to do? (15:14)

18) Is a United States Will valid in Germany and England? (16:04)

19) What are “forced heirship” rules? (16:56)

20) Am I entitled to a share of the estate if a foreign relative has died? (17:53)

21) What happens if someone contests the Will in Germany? (19:01)

22) Can I act as the executor or administrator abroad myself? (19:49)

23) I have foreign assets. How can I ensure they avoid probate? (20:22)

24) What is the principle of universal succession? (21:21)

– – –

The law firm Graf & Partners and its German-English litigation department GP Chambers was established in 2003 and has many years of experience with British-German and US-German probate matters. If you require advice or legal representation in a German or international inheritance case please contact German solicitor Bernhard Schmeilzl, LL.M. (Leicester) at +49 941 463 7070. Bernhard is also frequently asked by British and US Courts and Tribunals or by legal counsels to provide expert reports and legal opinions on German law, particularly German contentious probate matters and German inheritance tax issues.

[…] matter. Thus, contentious probate and disputes among co-heirs are rather common in Germany, because German intestacy rules often create such an Erbengemeinschaft (community of heirs) consisting of people who cannot stand […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] An in depth explanation of what happens when a German dies without a Will is available here. […]

[…] made a holographic will which disinherits those persons who would have been the heirs under German intestacy rules (more here), then the period the testamentary heirs must be patient is usually at least one or months longer […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] The German elective share is the statutory amount that a surviving spouse, descendant or parent may choose to take of the deceased’s estate as an alternative to what was provided (or rather: not provided) for him or her in the deceased spouse’s Last Will and Testament. Such election is not automatic and must be made within 3 years of gaining knowledge of having been disinherited (in practice, from issuing letters of administration, i.e. the German Erbschein). The Pflichtteil may be utilized if the Will leaves the spouse, child or parent less than he or she would otherwise receive by statute, i.e. German intestacy rules. […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] The application of foreign succession laws can lead to surprising results. Pleasant or unpleasant, depending on the degree of kinship with the deceased. Under German succession laws, for example, the surviving spouse has a much weaker position compared to the intestacy rules in England and Wales as well as Scotland. Details are explained here and here. […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] The German elective share is the statutory amount that a surviving spouse, descendant or parent may choose to take of the deceased’s estate as an alternative to what was provided (or rather: not provided) for him or her in the deceased spouse’s Last Will and Testament. Such election is not automatic and must be made within 3 years of gaining knowledge of having been disinherited (in practice, from issuing letters of administration, i.e. the German Erbschein). The Pflichtteil may be utilized if the Will leaves the spouse, child or parent less than he or she would otherwise receive by statute, i.e. German intestacy rules. […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]

[…] Most Germans die without a Will (German Intestacy Rules) […]