Seminar for British Solicitors and UK Accountants who advise Clients with Assets Abroad. Main focus is on Germany, but speakers will also briefly touch upon Austria and Switzerland.

If you advise clients who own property or other investments abroad, they are not always aware of the fact that this will trigger foreign inheritance taxes and that the executor(s) or beneficiaries will have to go through local probate procedure, which can takes many months and cost many thousands in legal and court fees. Smart Will preparation and other preparatory measures can mitigate costs and speed up foreign probate tremendously.

English Solicitor Stan Harris, OBE and German lawyer Bernhard Schmeilzl, LLM (Leicester) are experienced experts in international succession law, especially British-German probate matters and cross-border inheritance tax issues. On Thursday, 3 November 2016, they offer a seminar for British lawyers and accountants who advise clients with German assets, bank accounts, stocks and investments. Real life case studies will illustrate how to tackle efficiently tackle probate matters connected to Germany. The topics include:

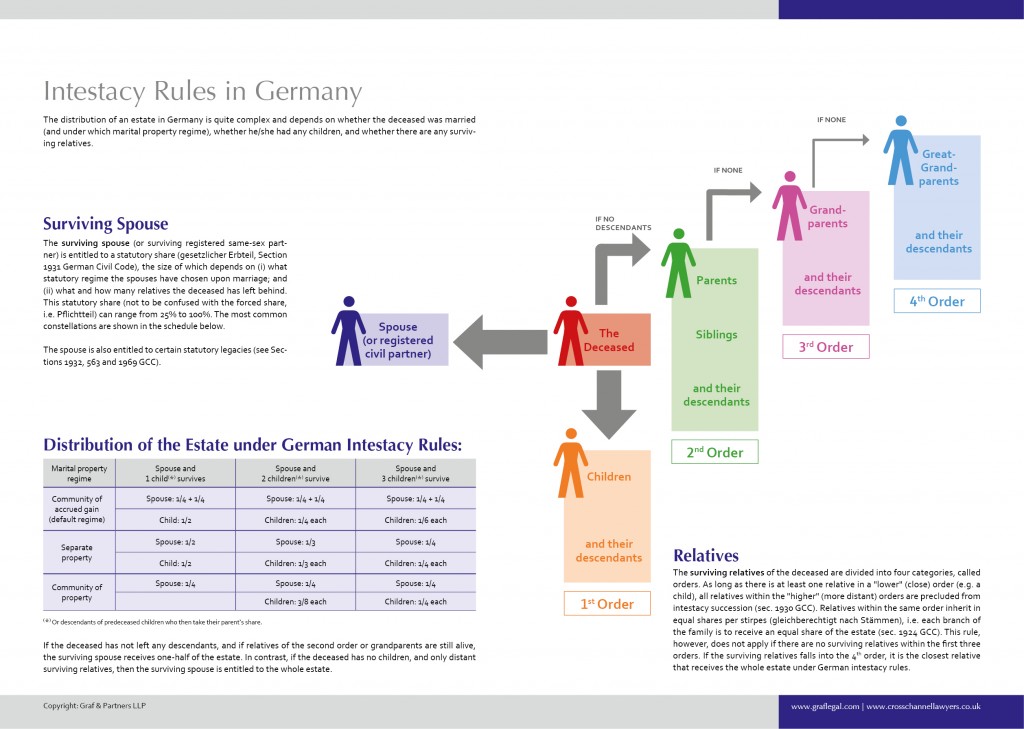

- Understanding German Wills and Intestacy Rules

- Will Preparation for International Families and Expats

- Making English Wills work in Germany

- Access Foreign Assets in Germany: is Probate unavoidable?

- Speed up Probate Procedure

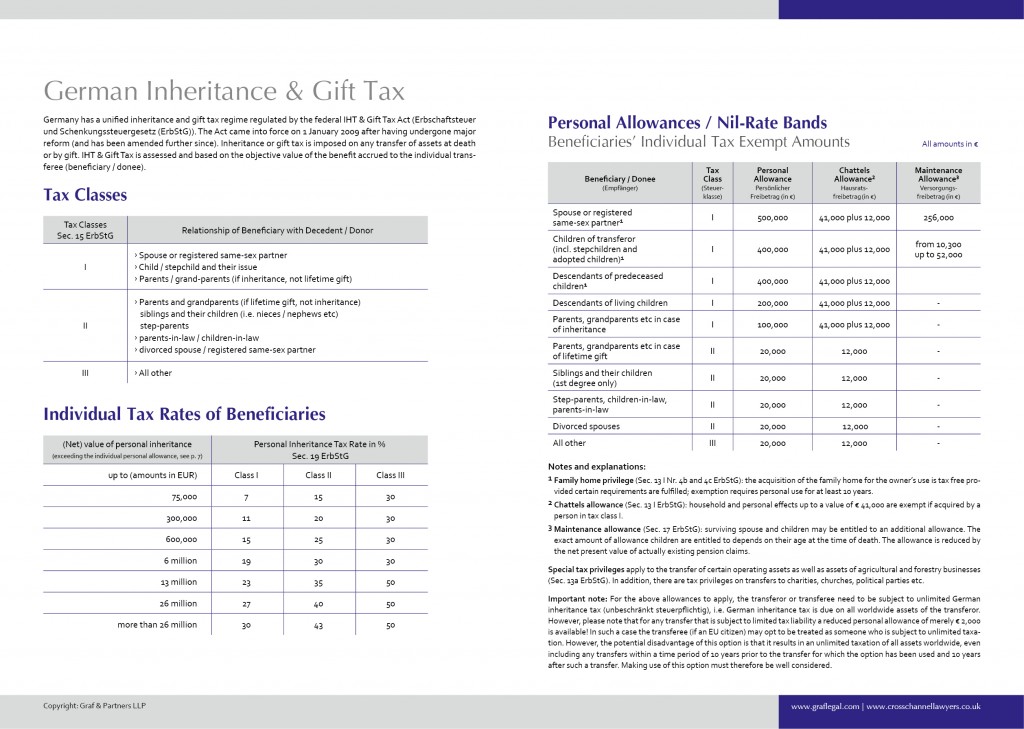

- Mitigate Inheritance Tax in both Countries

Some sample slides are available here:

For more information on German-British probate matters and international will preparation see the below posts by the international succession law experts of Graf & Partners LLP:

- Most Germans die without a Will (German Intestacy Rules)

- Formal Requirements to set up a valid Will in England, Scotland and Germany: What are the Differences?

- The Perils of German IHT and Gift Tax

- Basics of German Inheritance and Succession Law

- Executors and Trustees in German Inheritance Law

- How to apply for a German Grant of Probate

- The Infamous German Community of Heirs – And how to avoid it

- Germans Heirs are Personally Liable for Debts of the Deceased

- International Wills and Estate Planning for British-German Families

- Prove German Wills for English Probate

- Disputed Wills and Contentious Probate in Germany

- Disinherit your no-good children? Not so easy in Germany

- Don’t be afraid of Clients with Foreign Assets!

- Can foreign Taxes be set off against UK Inheritance Tax?

Or simply click on the “German Probate” section in the right column of this blog.

– – – –

The law firm Graf & Partners and its German-English litigation department GP Chambers was established in 2003 and has many years of experience with British-German and US-German probate matters, including the representation of clients in contentious probate matters. If you wish us to advise or represent you in a German or cross border inheritance case please contact German solicitor Bernhard Schmeilzl, LL.M. (Leicester) at +49 941 463 7070.

[…] Efficient Transfer of Foreign Assets […]

[…] Busfahren in London: Nächste Woche halten wir einen Vortrag zum Thema Nachlassabwicklung und Erbschaftssteuer in deutsch-britischen Erbfällen. Wer gerade in der Gegend ist, kann am 3. November ja mal am Tavistock Square vorbeischauen (es ist […]

[…] Unsere Kanzlei ist seit vielen Jahren auf deutsch-britische sowie deutsch-amerikanische Erbfälle spezialisiert und unsere Experten für internationales Erbrecht erstellen im Jahr gut 100 solcher Affidavits für englische, schottische, australische und US-amerikanische Erbfälle. Die deutschen und britischen Anwälte der Kanzlei halten auch regelmäßig Vorträge und Fortbildungsseminare für Anwälte, Steuerberater und Finanzberater zu den Themen deutsch-britisches Erbrecht, zur Nachlassabwicklung sowie zum internationalen Erbschaftsteuerrecht, etwa am 3. November 2016 in London. […]

[…] Unsere Kanzlei ist seit vielen Jahren auf deutsch-britische sowie deutsch-amerikanische Erbfälle spezialisiert und unsere Experten für internationales Erbrecht erstellen im Jahr gut 100 solcher Affidavits für englische, schottische, australische und US-amerikanische Erbfälle. Die deutschen und britischen Anwälte der Kanzlei halten auch regelmäßig Vorträge und Fortbildungsseminare für Anwälte, Steuerberater und Finanzberater zu den Themen deutsch-britisches Erbrecht, zur Nachlassabwicklung sowie zum internationalen Erbschaftsteuerrecht, etwa am 3. November 2016 in London. […]

[…] German Probate in International Inheritance Cases […]

[…] Rechtfsfragen spezialisierte Kanzlei hält zu diesen Themen regelmäßig Vorträge (siehe zum Beispiel hier), sowohl für Expats selbst, als auch für HR-Abteilungen internationaler Unternehmen sowie für […]

[…] German solicitor Bernhard Schmeilzl also conducts inhouse seminars for British and American lawyers and accountants who advise clients with foreign assets or who have family abroad. More on these seminars here: Advising Clients with Assets Abroad […]

[…] German solicitor Bernhard Schmeilzl also conducts inhouse seminars for British and American lawyers and accountants who advise clients with foreign assets or who have family abroad. More on these seminars here: Advising Clients with Assets Abroad […]