Testators with assets abroads

Why would an English or Scottish solicitor even give a toss about German or Spanish inheritance tax laws or about French or Italian forced heirship rules? Well, for starters, in order to avoid the client’s survivors yelling at him/her some years later because they ran into probate or/and foreign tax problems abroad.

Or, and this is of course the far better reason, to really impress your client with advice on international aspects of estate planning the client would otherwise never have thought of. Are you a solicitor or accountant who advises British clients with assets abroad or relatives living outside the UK? Then you might want to check whether you were already aware of some of the tripwires described in this post on international estate planning and will preparation.

Estate Planning for International Families requires seeing the big Picture

A solicitor who knows the basic principles of other jurisdiction’s succession rules and inheritance tax concepts is much more valuable to his client because such a solicitor can avoid structuring English Wills which may have counterproductive consequences in other countries.

The standard advice given by many English solicitors is still: “If you own assets abroad make a separate Will in each of those countries”. Well, this is simply not enough because such wills need to be synchronised both from a practical probate perspective and in regards to the overall inheritance tax consequences. Also, sometimes the better choice is to deal with the foreign assets directly in the English will.

Since 2003, the succession and tax lawyers of Graf & Partner specialise in international estate planning and will preparation with a strong focus on British-German, American-German, British-Austrian and American-Austrian inheritance cases and probate applications. German lawyer Bernhard Schmeilzl regularly gives presentations and conducts inhouse seminars for British and American lawyers and accountants who advise clients who possess foreign assets or who have relatives abroad who shall inherit or receive gifts or legacies. More on these seminars here: Advising Clients with Assets Abroad

The goal of our seminars on international inheritance and tax law is not to make the English solicitor a Jack of all trades or to expose the solicitor to liability risks. Instead, the goal is to give the solicitor a basic idea about where the English estate planning approach might cause problems elsewhere and then team up with the respective experts from those countries to find the best overall solution for the client and his family.

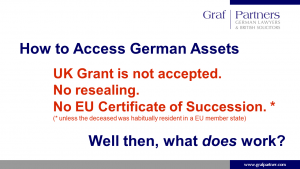

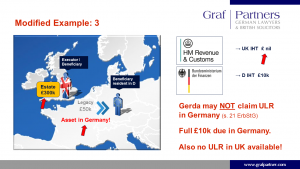

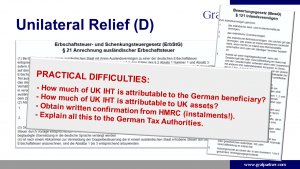

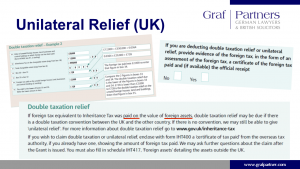

To give you an impression of the case studies we discuss in our workshops here are a few slides taken from our 90 page power point presentation: Presentation Wills and Estate Planning for International Clients

For more information on German-British or Austrian-British probate matters and international will preparation see the below posts by the international succession law experts of Graf & Partners LLP:

- Most Germans die without a Will (German Intestacy Rules)

- Formal Requirements to set up a valid Will in England, Scotland and Germany: What are the Differences?

- The Perils of German IHT and Gift Tax

- Basics of German Inheritance and Succession Law

- Executors and Trustees in German Inheritance Law

- How to apply for a German Grant of Probate

- The Infamous German Community of Heirs – And how to avoid it

- Germans Heirs are Personally Liable for Debts of the Deceased

- International Wills and Estate Planning for British-German Families

- Prove German Wills for English Probate

- Disputed Wills and Contentious Probate in Germany

- Disinherit your no-good children? Not so easy in Germany

- Don’t be afraid of Clients with Foreign Assets!

- Can foreign Taxes be set off against UK Inheritance Tax?

Or simply click on the “German Probate” section in the right column of this blog.

[…] solicitor Bernhard Schmeilzl also conducts inhouse seminars for British and American lawyers and accountants who advise clients with foreign assets or who have family abroad. More on these seminars here: […]

[…] der English Law Society zu internationalen Rechtsfragen statt. Wir bereiten hierfür Beiträge zu internationaler Nachlassplanung und Testamentsgestaltung […]

[…] solicitor Bernhard Schmeilzl also conducts inhouse seminars for British and American lawyers and accountants who advise clients with foreign assets or who have family abroad. More on these seminars here: […]

[…] solicitor Bernhard Schmeilzl also conducts inhouse seminars for British and American lawyers and accountants who advise clients with foreign assets or who have family abroad. More on these seminars here: […]