Understanding a German Inheritance Tax Statement

Inheritance tax in Germany is calculated very differently from the IHT in the United Kingdom. First of all, under German law, not the estate as such is being taxed but each individual beneficiary. Secondly, each beneficiary has an individual tax rate and an individual tax allowance, based on the amount received and the degree of kinship. And, last not least, German law applies the concept of gift tax which means that pre-death lifetime gifts are relevant for the caluclation of German IHT.

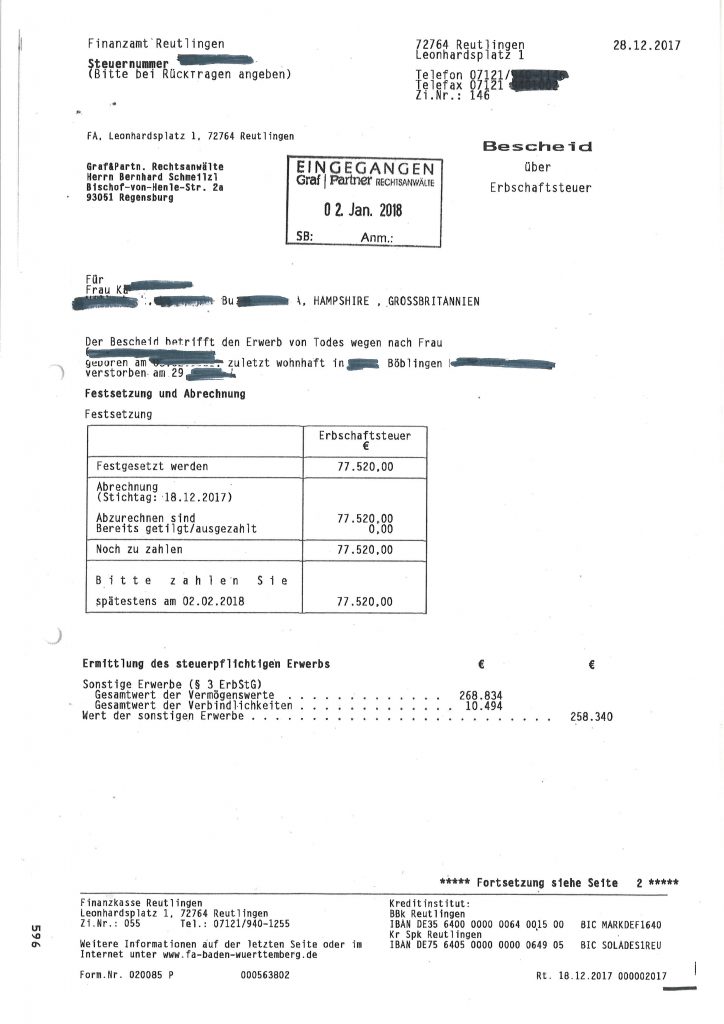

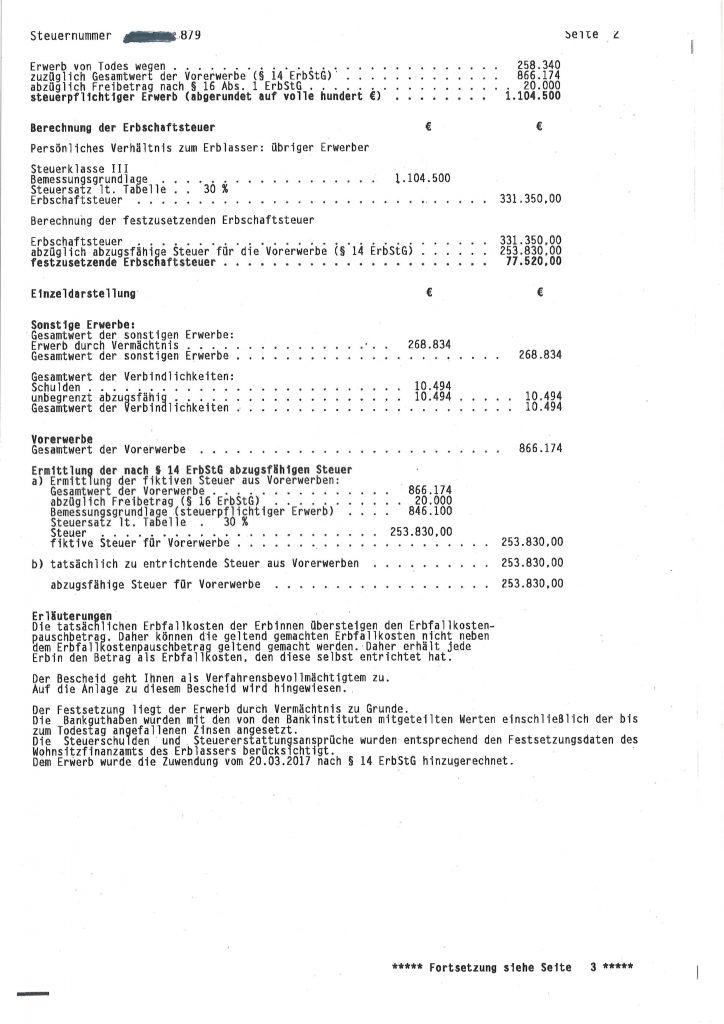

Sample German IHT Assessment Notice

Here is a practical real life example of a German Inheritance Tax Statement in a case where the decedent has made lifetime gifts to the beneficiary and – in addition to the pre-death gifts – has gifted half of the estate to the same donee.

Calculation of German Gift Tax and Inheritance Tax

In order to understand a German tax calculation one must know the terminology of the German Gift Tax and Inheritance Tax Code (Schenkungs- und Erbschaftsteuergesetz). The most important terms in the tax bill are:

- Erbschaftssteuer = Inheritance Tax

- Schenkungsteuer = Gift Tax

- Sonstige Erwerbe = Other Gifts (meaning any kind of gift except for the inheritance itself, mostly pre-death gifts or life insurance payments outside of the estate)

- Vorerwerbe = pre-death gifts and pre-death payments outside of the estate

- Steuerklasse = German IHT category (based on degree of kinship)

- Steuersatz = tax rate

- Freibetrag = personal allowance of the donee (this allowance also depends on the degree of kinship and ranges from only EUR 20,000 between unrelated persons to EUR 500,000 between spouses)

As mentioned above, a major difference between German and UK inheritance tax is that under German law all lifetime gifts do in principle trigger gift tax. Immediately when the gift is made, i.e. not only if the gift was made during the periof of 7 years prior to the date of death of the donor.

All such lifetime gifts (lebzeitige Schenkungen) and any inheritance are added together (if they happen within a period of ten years) and are then the basis on which the combined gift and inheritance tax is being calculated (see the above sample German IHT Tax Bill).

– – –

For more information on German gift & inheritance taxation, on German-British probate matters and on international will preparation see the below posts by the international succession law experts of Graf & Partners LLP:

- The Perils of German IHT and Gift Tax

- Can foreign Taxes be set off against UK Inheritance Tax?

- Brochure on German Probate and German Inheritance Tax (in English)

- German Tax Clearance Certificate (Inheritance Tax)

- Careful with Deeds of Variation in German-British Inheritance Cases

- Efficient Transfer of Foreign Assets

- Most Germans die without a Will (German Intestacy Rules)

- Formal Requirements to set up a valid Will in England, Scotland and Germany: What are the Differences?

- Basics of German Inheritance and Succession Law

- Executors and Trustees in German Inheritance Law

- How to apply for a German Grant of Probate

- The Infamous German Community of Heirs – And how to avoid it

- International Wills and Estate Planning for British-German Families

- Prove German Wills for English Probate

- Disputed Wills and Contentious Probate in Germany

- Disinherit your no-good children? Not so easy in Germany

- Don’t be afraid of Clients with Foreign Assets!

Or simply click on the “German Probate” section in the right column of this blog.

– – –

In case you need specific advice in a concrete case or assistance in German probate procedures, feel free to contact the lawyers of the German firm Graf & Partners which are specialized in British-German succession issues. Attorney Bernhard Schmeilzl has years of experience acting as executor and administrator of estates, both in the UK and in Germany. He is an expert in international succesion law and gives lectures and seminars for UK probate solicitors and UK accountants who advise clients with foreign assets.

In case you need specific advice in a concrete case or assistance in German probate procedures, feel free to contact the lawyers of the German firm Graf & Partners which are specialized in British-German succession issues. Attorney Bernhard Schmeilzl has years of experience acting as executor and administrator of estates, both in the UK and in Germany. He is an expert in international succesion law and gives lectures and seminars for UK probate solicitors and UK accountants who advise clients with foreign assets.

– – –

The law firm Graf & Partners was established in 2003 and has many years of experience with British-German and US-German probate matters. If you wish us to advise or represent you in a German or cross border inheritance case please contact German solicitor Bernhard Schmeilzl, LL.M. (Leicester) at +49 941 463 7070.