What is the German IHT Nil-Rate Band?

German inheritance law, including inheritance tax law, works very differently from the UK system (for German probate see here and here). While in the UK the estate as such is taxed (with one single nil-rate band of currently 325k GBP being available as tax relief) you find a completely different inheritance tax concept in Germany:

German tax authorities do not look at the estate but at the individual beneficiaries. Their respective personal gain is taxed (for details, what circumstances trigger German Inheritance Taxes see here).

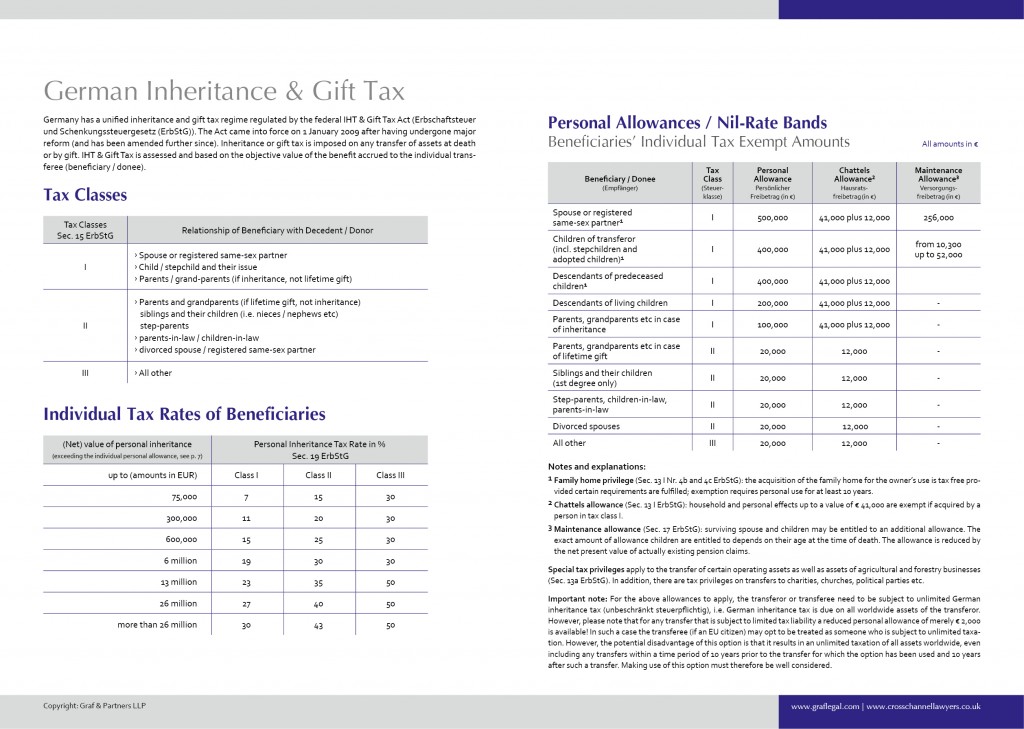

Each beneficiary (heir, legatee or donee) is personally responsible for filing an inheritance tax declaration (Erbschafts-Steuererklärung) and for informing the authorities about the amount he/she has received (whether the money has actually been paid out already or not). Depending on the degree of blood relationship of the beneficiary to the legator the beneficiary has a personal tax exempt amount. These personal tax exempt amounts vary hugely: from 500,000 Euro for spouses and 400,000 per child, to only 20,000 Euros for people that are not closely related. Only the amount exceeding this tax exemption will be taxed at a rate which again depends on the personal relationship of the beneficiary to the legator, from 7% up to 50%. A detailed table of German inheritance tax rates and personal inheritance tax exemptions is available here: German Inheritance Tax Exemption and Tax Rates

Since the surviving spouse has a personal allowance (individual tax exempt amount) of 500,000 Euro and each child of 400,000 Euro there is, in most cases, no (or very little) German inheritance tax due when someone dies who leaves issue and/or spouse behind. If a German testator has, for example, a wife and two children he can pass on 1.3 million Euro without any inheritance tax being due. In practice the inheritance tax free amount is in most cases even higher, because property (houses or apartments) is completely exempt from IHT (on top of the personal exempt amounts listed above) if the property is used as family residence. Finally, there are – somewhat complicated – tax privileges for businesses which allow shares to be transferred at less than real value if the business is being continued after the transfer for a certain grace period.

The full text of the German Inheritance and Gift Tax Act (Erbschafts- und Schenkungssteuergesetz) is available here.

For more information on German-British probate matters and international will preparation see the below posts by the international succession laws experts of Graf & Partners LLP

- Most Germans die without a Will (German Intestacy Rules)

- The Perils of German IHT and Gift Tax

- Basics of German Inheritance and Succession Law

- Executors and Trustees in German Inheritance Law

- How to apply for a German Grant of Probate

- International Wills and Estate Planning for British-German Families

- Prove German Wills for English Probate

- Disputed Wills and Contentious Probate in Germany

- Disinherit your no-good children? Not so easy in Germany

- Don’t be afraid of Clients with Foreign Assets!

- Can foreign Taxes be set off against UK Inheritance Tax?

Or simply click on the “German Probate” section in the right column of this blog.

In case you need specific advice in a concrete case or assistance in German probate procedures, feel free to contact the lawyers of the German firm Graf & Partners which are specialized in British-German succession issues. Attorney Bernhard Schmeilzl has years of experience acting as executor and administrator of estates, both in the UK and in Germany. He is an expert in international succesion law and gives lectures and seminars for UK probate solicitors and UK accountants who advise clients with foreign assets.

In case you need specific advice in a concrete case or assistance in German probate procedures, feel free to contact the lawyers of the German firm Graf & Partners which are specialized in British-German succession issues. Attorney Bernhard Schmeilzl has years of experience acting as executor and administrator of estates, both in the UK and in Germany. He is an expert in international succesion law and gives lectures and seminars for UK probate solicitors and UK accountants who advise clients with foreign assets.

– – –

For more information on German law and the German legal system: the bilingual brochures “Law – Made in Germany” (free download here) as well as “Continental Law” (free download here). If you wish to look up specific German legislation you find central German statutes on the website of the German Department of Justice (here), including an English version of the Code of Civil Procedure. The German Civil Code (Bürgerliches Gesetzbuch) is available for download here: German_Civil_Code_in_English_language.

The law firms Graf & Partners (Germany) and Lyndales (UK) have many years of experience in civil and business law matters as well as litigation. So, should you need assistance with British-German legal issues do not hesitate to contact us by email at: schmeilzl [at] grafpartner.com

[…] third major difference is inheritance tax: While in the UK there is one nil-rate band for the entire estate and the amount above that is taxed […]

[…] ← Previous […]

[…] German Inheritance Tax Rates and Personal Tax Exempt … – German inheritance law works very differently from the UK system. In the UK the estate is taxed. A completely different inheritance tax concept works in Germany […]

[…] German Inheritance Tax concept works entirely differently (basics explained here). It taxes the individual beneficiary. However, if that beneficiary is domiciled outside Germany, […]

[…] these posts, you can find more information on German Probate, German Inheritance Tax and Will Preparation. In case of contentious probate, disputes can be brought either before a […]

[…] to avoid any misunderstanding: These transfers of assets outside of the estate are still subject to German inheritance tax and the German banks will require to see an official tax clearance certificate (more here) before […]

[…] Problem 1: The nephew (or his German lawyer) will argue that the wording “free of any tax” also applies to German inheritance tax. Under German law, the nephew only has a personal IHT allowance of €20,000, which means that the remaining amount (€80,000) is subject to German IHT. In this case (a nephew receiving €100,000), the tax rate is 20%. If the amount or the relation is different, there can be very different tax rate (detaiils of German IHT rates are explained here). […]

[…] German Inheritance Tax concept works entirely differently (basics explained here). Instead of taxing the estate, it taxes each individual beneficiary. However, if that beneficiary […]

[…] Adopting an adult person (Erwachsenenadoption) is increasingly popular in Germany, especially in wealthy cities like Munich, Frankfurt or Berlin. Why so? Because a child — including an adopted adult — is entitled to claim the maximum German personal gift & inheritance tax allowance of EUR 400,000. More distant relatives, for instance nieces and nephews, only have a meager EUR 20,000 tax allowance available. Furthermore, the German gift tax rates differ extremely depending on the degree of kinship. Children and grandchildren find themselves in the German IHT tax category 1 (Steuerklasse 1) which starts at a tax rate of 7%, whereas more distant relatives or persons not related at all are taxed at 30% to 50%. More information on German inheritance tax and gift tax here. […]

[…] Problem 1: The nephew (or his German lawyer) will argue that the wording “free of any tax” also applies to German inheritance tax. Under German law, the nephew only has a personal IHT allowance of €20,000, which means that the remaining amount (€80,000) is subject to German IHT. In this case (a nephew receiving €100,000), the tax rate is 20%. If the amount or the relation is different, there can be very different tax rate (detaiils of German IHT rates are explained here). […]

[…] these posts, you can find more information on German Probate, German Inheritance Tax and Will Preparation. In case of contentious probate, disputes can be brought either before a […]

[…] German Inheritance Tax Rates and Personal Tax Exempt Amounts […]

[…] … is necessary for a foreign beneficiary to be able to access the German estate. In addition to a Certificate of Inheritance (details here) the banks, insurance companies or other third parties that hold assets of the deceased will demand to see a Certificate of Non-Objection or Tax Clearance Certificate (in German called “Unbedenklichkeitsbescheinigung”) issued by the German Tax authorities (Finanzamt). The reason for this is that according to Section 20 para. 6 German Inheritance Tax Act (Erbschafts- und Schenkungssteuergesetz), the holder of any asset of the bequeather is personally liable for any accrued unpaid tax debts. No bank or insurance company will take the risk of transferring credit before they have seen the tax clearance certificate. More on German inheritance tax here. […]